Understanding Crypto Scalping Cryptocurrency scalping is a trading strategy that involves making small, frequent trades to capitalize on short-term price…

Introduction Welcome to the exhilarating world of advanced crypto day trading, where fortunes are made and lost in the blink…

Subheading: Introduction Are you ready to take your cryptocurrency trading to the next level? Look no further than Reddit, where…

Understanding the Crypto Landscape In recent years, cryptocurrency has emerged as a hot topic in the world of finance, attracting…

Introduction In today's fast-paced digital economy, investing in cryptocurrencies has emerged as a popular avenue for individuals seeking to diversify…

Introduction: Welcome to the world of cryptocurrency, where opportunities abound for new investors eager to dip their toes into this…

Subheading: Understanding the Cryptocurrency Landscape In the realm of cryptocurrency, understanding the landscape is crucial for success. Cryptocurrencies operate on…

Introduction In the world of cryptocurrency trading, mastering the art of buying and selling is essential for success. It's not…

Introduction: Embarking on a journey into crypto investing is akin to navigating uncharted waters. While the potential for profits is…

Introduction: Welcome to the world of cryptocurrency investing, where opportunities abound for savvy investors. In this article, we'll delve into…

Introduction: Investing in cryptocurrency requires more than just luck; it demands mastery of key strategies to navigate the ever-changing market…

Introduction: Day trading cryptocurrency can be both exhilarating and daunting, but mastering it is entirely feasible with the right strategies…

Introduction In the realm of cryptocurrency investing, opportunities abound for those willing to navigate the volatile waters of the market.…

Introduction: Welcome to the world of daily crypto trading, where quick decisions and strategic moves can make all the difference…

Subheading: Understanding Intraday Trading Intraday trading in the cryptocurrency market involves buying and selling assets within the same trading day.…

Introduction Cryptocurrency trading can be a thrilling endeavor, but it's not for the faint of heart. With its volatile nature…

Introduction: Welcome to the world of cryptocurrency, where buying digital assets can be both exhilarating and complex. As you navigate…

Introduction: Cryptocurrency has revolutionized the financial landscape, offering unprecedented opportunities for investors. However, navigating this volatile market requires careful consideration…

Unveiling Linus Tech Tips' Guide to Cryptocurrency Explained Introduction: In recent years, cryptocurrencies have taken the world by storm, revolutionizing…

Introduction: In the fast-paced world of cryptocurrency, navigating the market can be a daunting task for newcomers and seasoned investors…

Introduction: Welcome to the world of crypto scalping, where quick decisions and rapid-fire trades can lead to substantial profits. Mastering…

Introduction: Welcome to the exciting world of cryptocurrency markets, where fortunes are made and lost in the blink of an…

Subheading: Introduction Are you looking to take your cryptocurrency trading skills to the next level? In the fast-paced world of…

Understanding the Importance of Crypto Security In the fast-paced world of cryptocurrencies, where digital assets are traded and stored online,…

Introduction: In the fast-paced world of cryptocurrency trading, success is not merely a matter of luck; it requires skill, strategy,…

Subheading: Unlocking the Power of Telegram Crypto Insights In the fast-paced world of cryptocurrency trading, staying ahead of the curve…

Introduction: Welcome to the world of crypto staking, where investors can earn passive income by participating in blockchain networks. However,…

Introduction In the fast-paced world of cryptocurrency day trading, unlocking profit potential requires a strategic approach and disciplined execution. In…

Understanding Cryptocurrency Trading Cryptocurrency trading has surged in popularity, offering opportunities for individuals to profit from the dynamic digital asset…

Revolutionizing Digital Transactions with One Harmony Crypto Understanding One Harmony Crypto Welcome to the world of One Harmony Crypto, where…

Subheading: Understanding Cryptocurrency Investing Cryptocurrency investing has emerged as a lucrative opportunity for investors seeking high returns in the digital…

Subheading: Understanding Cryptocurrency Investment Cryptocurrency investment has become a lucrative avenue for those seeking to diversify their portfolios and capitalize…

Introduction Investing in cryptocurrencies has become increasingly popular as more people recognize the potential for substantial profits in this rapidly…

Introduction In the fast-paced world of cryptocurrency trading, mastering intraday trading strategies can make all the difference between success and…

Unlocking the Power of Polker: Redefining Poker with Cryptocurrency Integration The Rise of Polker In the realm of online gaming,…

Introduction In the dynamic world of cryptocurrency trading, staying ahead of the game is paramount. With markets that fluctuate by…

Subheading: Understanding the Cryptocurrency Landscape In the fast-paced world of cryptocurrency, understanding the basics is paramount. Cryptocurrencies are digital or…

The Rise of Power Ledger in Crypto Energy Revolution Empowering Decentralized Energy Power Ledger, a trailblazer in the realm of…

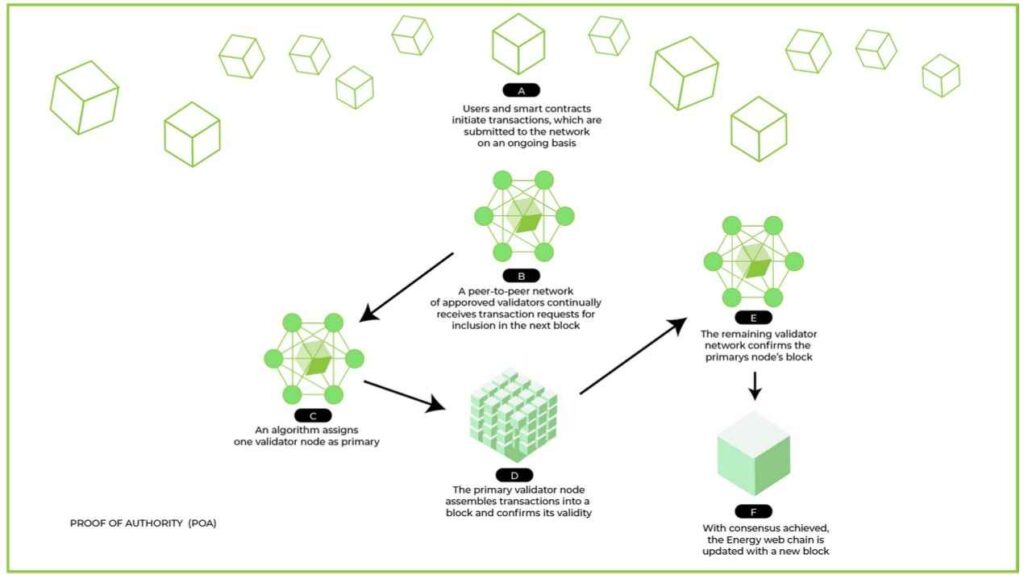

POA Crypto: Unlocking Blockchain Potential Introduction: In the ever-evolving landscape of cryptocurrency, POA (Proof of Authority) stands out as a…

Exploring Phaeton: Unraveling the Crypto Revolution The Rise of Phaeton In the ever-evolving landscape of cryptocurrency, Phaeton emerges as a…

Powering the Future of Digital Transactions: Proton Blockchain The Rise of Proton Blockchain In the ever-evolving landscape of digital finance,…

Exploring the Potential of Nervos Crypto: A Deep Dive into Layer 1 Solutions Unleashing the Power of Layer 1 In…

Unveiling Parsiq: The Future of Crypto Monitoring Understanding the Importance of Crypto Monitoring In the fast-paced world of cryptocurrency, monitoring…

Unlocking the Future of Tokenization with Polymesh Crypto Introduction In the rapidly evolving landscape of blockchain and digital assets, Polymesh…